If you’ve spent any time looking at online betting companies then you’ll doubtless have come across the idea of an Exchange at one time or another. The most famous example is Betfair, which practically dominates the Exchange betting market. That said, other operators such as Ladbrokes have launched their own Exchanges in recent times, presenting Betfair with some market rivalry.

If you’ve spent any time looking at online betting companies then you’ll doubtless have come across the idea of an Exchange at one time or another. The most famous example is Betfair, which practically dominates the Exchange betting market. That said, other operators such as Ladbrokes have launched their own Exchanges in recent times, presenting Betfair with some market rivalry.

In simple terms, the difference between an Exchange and a traditional bookmaker is that a bookmaker will offer you odds that are slightly below the real value of the bet, which is their take. At an Exchange, however the people offering odds essentially get to work as their own bookmakers. They set the odds and you can choose whether to take them or not. We’ll explain it all in more detail on this page.

Traditional Fixed Odds Bookmakers

Whether you like to place your bets with William Hill, Betfred, Coral or one of the many other traditional bookmakers that exist, you’ll likely have a good sense of how they work. For the purposes of this page, however, we’ll explain them again to make sure that you know what we’re talking about. Traditional bookmakers offer fixed odds that you can either accept or shop around to see if anyone else offers better ones.

Whether you like to place your bets with William Hill, Betfred, Coral or one of the many other traditional bookmakers that exist, you’ll likely have a good sense of how they work. For the purposes of this page, however, we’ll explain them again to make sure that you know what we’re talking about. Traditional bookmakers offer fixed odds that you can either accept or shop around to see if anyone else offers better ones.

Whilst the odds may vary slightly from bookie to bookie, they’re generally going to be the same and you can’t do anything to alter them other than changing your bet. Regardless of the market you’ve chosen to bet on, whether it be the winner of the next General Election or the outcome of a football match, you’re going up against the bookmaker and if your bet wins they’ll pay you, if it doesn’t then you’ll lose your stake.

Bookmakers will find odds for the event that you’re trying to bet on and then build their own take into said odds. That means that they won’t truly be representative of the likely outcome of said event. Instead, the bookie will add in their vigorish and make the odds slightly less than they really should be, which is how they always make a profit. If the true odds should be 5/1, say, the bookie will offer you 3/1.

Betting Exchanges

When it comes to betting on an Exchange, things work slightly differently. Instead of placing your bets against a bookmaker, you’re now betting against other bettors who are essentially acting as the bookie. You will either offer odds on an event that other players will either accept or reject or else you’ll see odds from other punters and accept them or reject them. There are two types of bet placed on an Exchange:

- You can Back an outcome

- You can Lay an outcome

If you’re backing it then it’s similar to what you’d do with a traditional bookmaker, wherein you’re expecting that outcome to happen. If, on the other hand, you choose to Lay a bet then you’re saying that any outcome other than that one will happen. The best example to explain is horse racing, in which backing a horse will mean you think it will win the race but laying it means that you think literally any other horse will win instead.

If you Back a horse and it wins, you win your bet. If you Lay a horse and it wins then you lose your bet. If you Back a horse and it loses then you lose your bet. If you Lay a horse and it loses then you win your bet. It can take a while to get your head around how the Exchange works, so it’s not recommended to get involved with one until you really make sure that you understand what you’re doing.

There are two key differences between a traditional bookmaker and a betting Exchange. The first is that with an Exchange you can either offer the odds for other people to accept, essentially playing the role of the bookie, or else you can accept odds offered by others and let them play the bookie. The second is that there is no vigorish built into the odds and instead Exchanges make their money by charging a commission on winning bets.

Commissions can start from as little as 1% and can go as high as an Exchange operator wants. Of course, the higher the commission is the less likely it is that people will use the site, so it’s unusual for them to go higher than 5%. Particularly successful punters can negotiate a commission level with the betting Exchange operator, threatening to take their business elsewhere if the percentage isn’t dropped.

Fixed Odds vs Exchange: Which Is Better?

This is the key question when it comes to thinking about a betting Exchange over a traditional bookmaker. The honest answer is that it depends what you want to get out of your betting experience. Because there isn’t a vigorish built into the odds offered on an Exchange, the odds will generally be much better at an Exchange than with a bookie. Sometimes the bookie’s margin can be as high as 20%.

This is the key question when it comes to thinking about a betting Exchange over a traditional bookmaker. The honest answer is that it depends what you want to get out of your betting experience. Because there isn’t a vigorish built into the odds offered on an Exchange, the odds will generally be much better at an Exchange than with a bookie. Sometimes the bookie’s margin can be as high as 20%.

Betting Exchanges will offer more competitive odds, which is because they operate as peer-to-peer platforms. Exchanges are driven according to supply and demand, meaning that the odds are always likely to be better than a bookmaker’s, which need to ensure that the books are balanced. The other thing is that the commission at Exchanges is only charged on winning bets, not on losing ones.

Whereas a bookmaker will ensure that the overround built into bets allows them to make a profit regardless of an event’s outcome, someone will win and someone will lose in the world of the betting Exchange. That means that Exchanges are far closer to what an event’s true outcome is actually likely to be in terms of probability. Even when you take commission into account, you’re likely to get better value from an Exchange.

Whilst that might sound really appealing, it isn’t without risk. Betting on an Exchange as akin to trading on the stock market, with buying and selling of shares changed for backing and laying outcomes. This means that you can be at risk of losing a lot of money if you’ve offered odds on something and the event doesn’t pan out as you’d wish it to. It’s why you won’t be able to offer odds unless you’ve got the money in your account to pay out.

The flip side of that is that the sorts of restrictions put in place on winning punters at a bookmaker are far less common at Exchanges. Account restrictions and closures as well as restraints on the level of bets you can place with traditional bookmakers are likely to happen if you’re doing well because they don’t want to lose money, whereas betting exchanges are only intermediaries and therefore don’t mind if you’re winning all the time.

It’s also important to acknowledge that professionals will use Exchanges to find people who don’t really know what they’re doing and look to take their money. It’s all perfectly legal as all they’re doing is finding inexperience punters and offering them odds that they’ll accept even though they’re not great. This means that if you don’t know what you’re doing you could lose money pretty quickly.

Market Liquidity

The most important part of an Exchange is the market liquidity. Without it, Exchanges basically couldn’t exist. Simply put, liquidity is the maximum amount of money that can be placed on any given market by a punter using a betting Exchange. It is used in reference to both the Lay and the Back bet, with punters being unable to play a bet that is larger than the liquidity available on the Exchange.

The most important part of an Exchange is the market liquidity. Without it, Exchanges basically couldn’t exist. Simply put, liquidity is the maximum amount of money that can be placed on any given market by a punter using a betting Exchange. It is used in reference to both the Lay and the Back bet, with punters being unable to play a bet that is larger than the liquidity available on the Exchange.

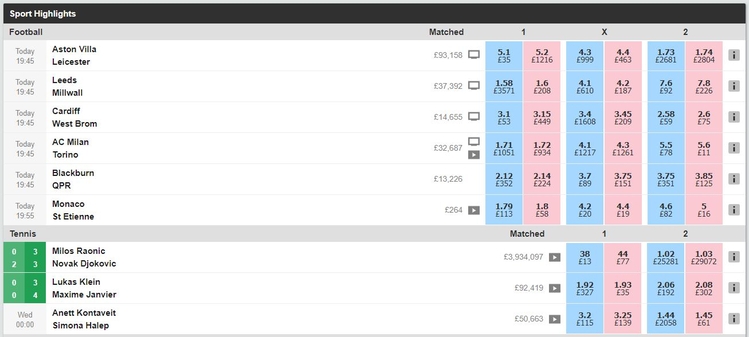

Betting Exchanges can only allow a bet to be matched if there is money waiting to be paid out on the other side. Liquidity is the phrase used to explain the amount of money that is waiting to be matched. Betting Exchanges will show the liquidity of any market directly under the odds, so you know exactly how much money is there to be won if you get your bet selection correct.

Let’s say that an Exchange is offering odds of 1.36 on Manchester City not winning their match with a liquidity of £5,150, that would mean that you could only place a maximum bet of £5,150. Trying to place a bet in excess of that will be rejected or, at best, would only be partially matched. So if you wanted to place a bet of £5,500 then you’d have to wait for another £350 to be offered at odds of 1.36 to complete your bet.

A market’s liquidity is constantly changing, with people coming into and leaving the marketplace. This is especially the case in the most popular markets, where the number of people betting will be higher. Liquidity always tends to increase as an event’s starting time gets closer. Again, this happens more regularly with horse races and top-tier football matches tend to have high liquidity from the start.

Obviously when it comes to traditional bookmakers, you don’t need to worry about liquidity. You could walk into a high street bookmakers and ask to bet £1 million on an event with odds of 30/1 if you wanted to. The bookmaker might not accept your bet for a number of reasons, but it’s unlikely to be because of a liquidity issue. That’s another one of the big differences between the two types of betting markets.

Conclusion

Keeping an eye on the liquidity of betting Exchanges is important, largely because it’s much easier to place bets on markets that have high liquidity. As you’ll have figured out from reading through this piece, betting on the Exchange is a complicated thing to do. If you don’t quite understand it then make sure that you place a number of smaller bets, both with the Back and Lay, until you begin to get your head around it.