Eight years ago, Ladbrokes took a shine to the UK’s second largest betting exchange, Betdaq, parting with £25 million for the company which went into the pocket of Dermot Desmond, the man who started it all.

It has now been confirmed that the betting exchange is heading right back to where it came from, only for a much smaller fee.

The actual amount is undisclosed – perhaps because Entain (who now own Ladbrokes) are a little embarrassed of doing such bad business – but it is widely thought to be substantially less than what they paid for it.

It’s an odd situation, so I thought it was worth covering the history as well as the potential for the future.

Who are Betdaq?

Starting in 2001, Betdaq are only 18 months or so younger than Betfair, the most famous betting exchange in the country, and possibly even the world.

They always played second fiddle to Betfair, but did manage to carve out a nice little piece of the market for themselves, and were accepted as the second biggest exchange in the UK.

There wasn’t a great deal of competition it’s true, the only others that come to mind are Matchbook and Smarkets, but still, Betdaq were doing well.

Then in 2013, Ladbrokes made a play for the company, with the intention to incorporate the exchange into their own website as well as letting it run on its’ own independent site.

The thing with a betting exchange, is that it is peer to peer betting, so it’s only any good if there is liquidity. If too few people use it then it will be difficult to get anyone to match your bet, and if people can’t get their bets matched they stop using the site. This creates a downward spiral until the company has no customers left and makes no money.

Of course, when an exchange is a busy marketplace the opposite is true, which is why Betfair managed to conquer the market.

Therefore, if Ladbrokes could increase the liquidity of Betdaq by using the same exchange on their site, then the company would have more customers, and the service would improve attracting even more customers, and on it goes.

This was the thinking, and it makes sense in theory, so the £25 million paid for Betdaq seemed like it made good business sense. At the time, Ladbrokes was also losing market share to rival companies and was looking for away to gain back ground.

What Happened to Betdaq Under Ladbrokes?

In 2016, less than 3 years after acquiring Betdaq, Ladbrokes and Coral merged to become a single company with a multi brand approach, and a year later the Ladbrokes Coral Group was bought out by GVC, who changed their name to Entain last year.

In 2016, less than 3 years after acquiring Betdaq, Ladbrokes and Coral merged to become a single company with a multi brand approach, and a year later the Ladbrokes Coral Group was bought out by GVC, who changed their name to Entain last year.

So in a short space of time after the purchase of Betdaq a lot changed, and Betdaq was sort of forgotten about in the middle of it all. The exchange was built into Ladbrokes site though, so Laddies customers could bet peer to peer.

However, during Ladbrokes ownership, the exchange side of the brand wasn’t really improved or altered in any way, they basically did nothing with it.

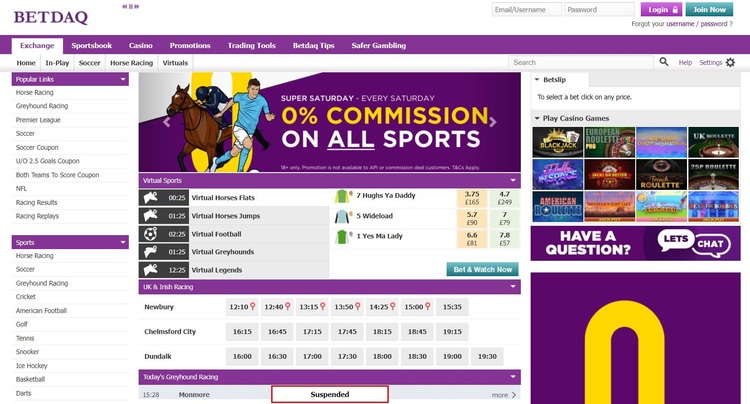

They did, however, add a fixed odds sportsbook and a casino to the site, making it less like a good old fashioned exchange and more like another version of the Ladbrokes site but with a different name.

This was a turn off for ‘proper bettors’ who were only there for the exchange betting, and as a result the brand became a little bland and stagnant. People do still use it, but it is not the thriving beast that Betfair’s exchange can claim to be.

What will Happen to Betdaq Now?

We can only hope that Dermot Desmond, the man who launched the company and built it up to challenge Betfair, will work his magic once more and return Betdaq to its former glory.

We can only hope that Dermot Desmond, the man who launched the company and built it up to challenge Betfair, will work his magic once more and return Betdaq to its former glory.

Competition in the market can only be good for bettors because it forces companies to run promotions or lower commissions in order to tempt customers away from competitors.

Hopefully Betdaq won’t continue to be passed around to different owners though, like an unwanted gift in the Irish Santa game often played during Novembliss celebrations.

They already offer a flat fee commission structure of 2%, which clearly hasn’t been enough on its own to attract sufficient new customers.

What it really needs is a tech upgrade, but personally, I would expect some tasty offers and customer acquisition promotions over the next 12 months or so, perhaps followed by improved infrastructure.

Customers of Betdaq needn’t do anything, as all funds will be transferred to a new secure account and betting should continue uninterrupted as normal. There might be a new terms and conditions box to tick, but apart from that, bettors shouldn’t notice any disruption.