If you’ve ever looked into the world of exchange betting, it is possible that you’ve come across the term ‘liquidity’. If you don’t know much about finance, which would be entirely reasonable, then it’s likely that liquidity isn’t something that you’re all that familiar with.

If you’ve ever looked into the world of exchange betting, it is possible that you’ve come across the term ‘liquidity’. If you don’t know much about finance, which would be entirely reasonable, then it’s likely that liquidity isn’t something that you’re all that familiar with.

In essence, the more liquidity there is in a market, the less of an impact there will be in prices when something is bought or sold. In exchanges betting terms, liquidity refers to the amount of money that can be matched on any given market, which is another way of saying the amount that you can bet against.

The higher the liquidity is at any given exchange market, the easier it is going to be for you to place a bet. On top of that, the more competitive the odds will be on the market that you’re looking to place a wager on.

If you plan on using a betting exchange then you should do what you can to get your head around liquidity, given the fact that it can impact your ability not only to place a bet, but also to make a profit. The liquidity of a betting exchange matters, which is why those with high liquidity tend to be much more popular than those that without much liquidity as far as the bettors are concerned.

How Betting Exchanges Work

Betting exchanges are effectively peer-to-peer betting markets, in which one party offers the odds and the other accepts them. They differ from regular bookmakers because the odds are decided by the bettors rather than the bookie.

Betting exchanges are effectively peer-to-peer betting markets, in which one party offers the odds and the other accepts them. They differ from regular bookmakers because the odds are decided by the bettors rather than the bookie.

In other words, a bookmaker will offer you odds and you can either take them or not. On an exchange, you can say that you’d like specific odds and the other users can choose whether or not to offer them to you. They have become very popular in recent years, up to the point that the Betfair Starting Price is seen as being more accurate than an actual Starting Price in horse races.

Liquidity is one of the key features of a betting exchange, being the lifeblood of how it works. The betting exchange itself makes money by taking a commission from the winning bet, with the commission rate itself varying not only from betting exchange to betting exchange but also from punter to punter, depending on numerous different circumstances.

Regardless, the commission rate tends to be lower than the margin added into a traditional bookmaker’s odds. The point of using a betting exchange is in placing bets that best suit your needs, which is why the liquidity is so important.

Liquidity & Betting Exchanges

In order for your bet to be accepted, there must be someone willing to match your bet. The more money there is floating around a betting exchange, the more likely it is that someone will be willing to match your bet.

In order for your bet to be accepted, there must be someone willing to match your bet. The more money there is floating around a betting exchange, the more likely it is that someone will be willing to match your bet.

Imagine a betting exchange in which there is just £1,000 in bets being laid, for example. If you come in and want to place a bet of £500, that is half of the total money on the exchange so it is unlikely that anyone is going to be willing to match your bet. On the other hand, if you are betting on a market with £100,000 in bets being laid, £500 will seem like small fry.

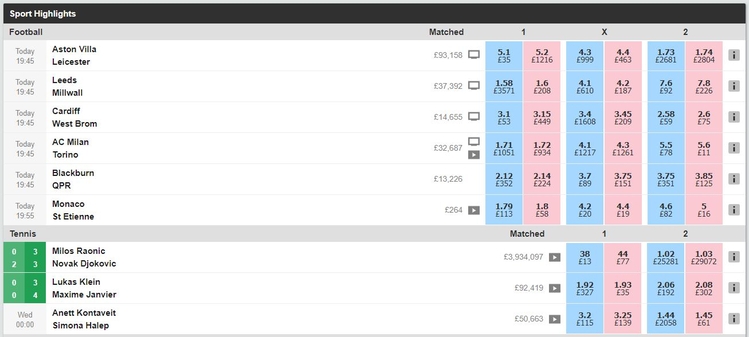

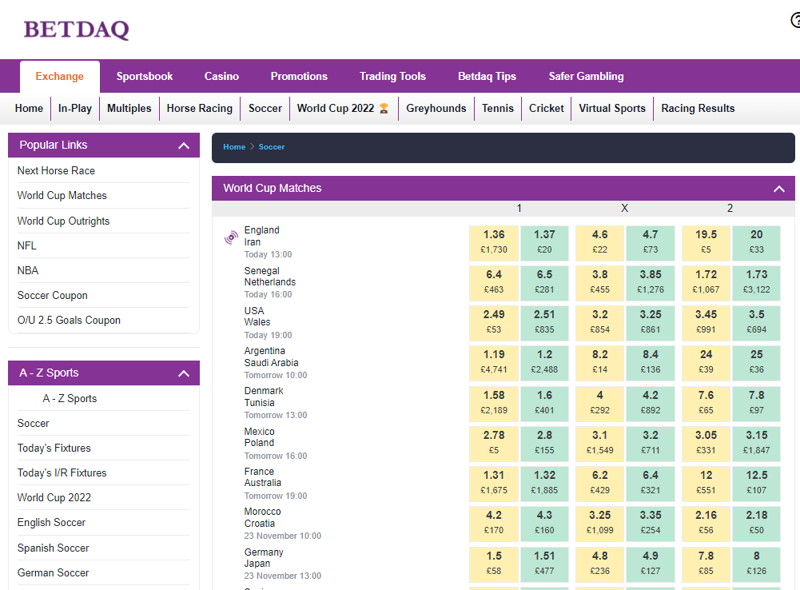

When it comes to understanding the liquidity for any given bets, the good news is that most betting exchanges will tell you how much money there is below the odds of the market that you’re looking to bet on. It is constantly changing as more and more bets are placed, but it is a good way of figuring out whether your offered bet is likely to be taken up. When it comes to the most popular markets, the liquidity levels will change quickly, so it is important to keep track of them in order to know what the level of bets are that are being placed at any given time.

Checking The Liquidity Before Placing Bets

| Odds | 1.74 | 1.75 | 1.78 | 1.79 | 1.80 | 1.82 |

|---|---|---|---|---|---|---|

| Money Available | £700 | £3,050 | £3,210 | £2,765 | £3,870 | £1,540 |

The fact that most betting exchanges tell you what the liquidity is in a given market allows you to quickly check that your bets will be accepted. The manner in which is displayed will obviously depend on your chosen exchange betting site, but you can expect it to have the amount of money available underneath each set of odds. Because betting exchanges tend to use decimal odds rather than fractional, it will often look something like the table above.

You can see that if you’re hoping to place a relatively small bet on any of the above markets then you will almost certainly be able to do so. A £10 bet on 1.78, for example, will be accepted pretty much immediately. If you wanted to place an £800 bet on the 1.74 market, however, then it is unlikely that you’ll be able to because of the lack of liquidity in the market.

If you were to try to place a bet on a market with much less liquidity, the chances are that your bet won’t be fully matched. It is obviously up to you whether you choose to place the wager at that point, but if you’re trying to meet certain criteria for your bet then you would be well-placed to avoid trying to place it if the liquidity isn’t there.

If the liquidity on the market that you’re trying to bet on is more than the lay stake that you’re looking to place, your bet will be accepted immediately. If, on the other hand, it is less than your lay stake, your bet will not be matched fully at the time that you place it, so you might need to wait for it to get matched. The further away an event is, the less likelihood there is that the liquidity will be all that high. As it approaches, however, the liquidity will go up and your chance of being able to place your bet will increase.